indiana estate tax return

E-File is available for Indiana. If the return is needed for a loan or other service of that nature permission by the taxpayer must be sent in writing to the.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

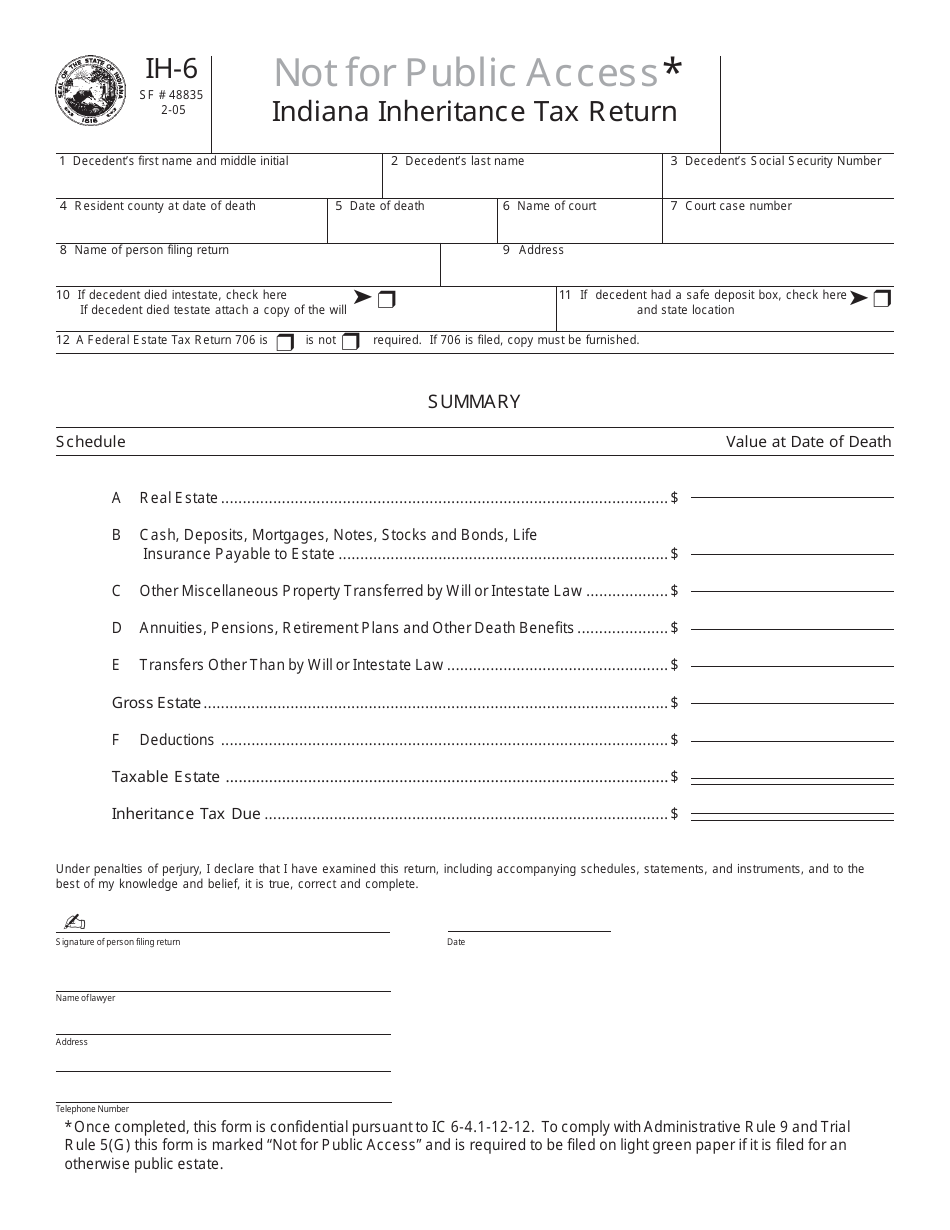

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

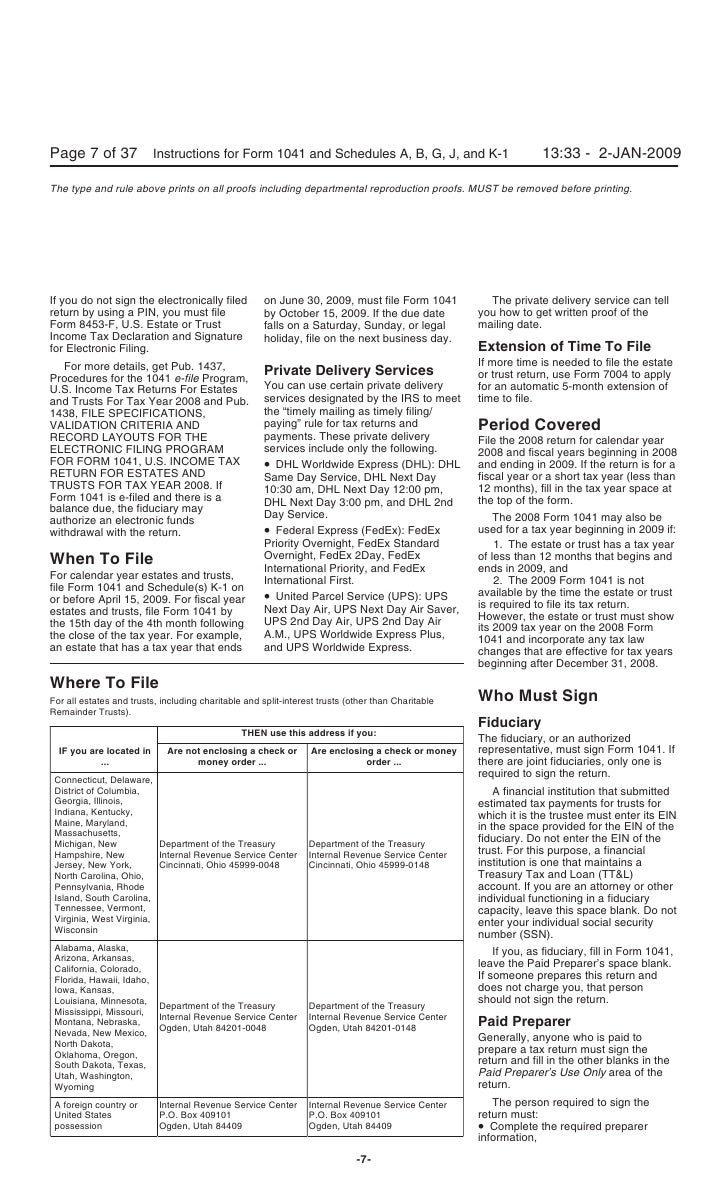

. The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO. This tax return is used by the fiduciary representative to report the income deductions gains losses etc. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

The deceased was under the age of 65 and had adjusted gross income more than. Individual trust guardian or estate. Box 71 Indianapolis IN 46206-0071.

If you are filing a calendar-year return please enter the 4-digit tax year in the box YYYY. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. In addition no Consents to Transfer Form IH-14.

The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. Please read carefully the general instructions before preparing. The income that is either.

Find federal tax forms eg. Indiana Current Year Tax Forms Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year.

55891 Beneficiarys Share of Indiana Adjusted Gross. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption. Income Tax Return for Estates and Trusts.

Direct Deposit is available for Indiana. Indiana Fiduciary Income Tax Return 0821 fill-in pdf IT-41ES. Individuals IT-40 Indiana Individual Income Tax Return.

Indiana Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download fill out. Of the estate or trust. 1099 1040 from the IRS.

Estate Tax Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. A six month extension is available if requested prior to the. Tax returns only are obtainable by the individual who filed the return.

Fill-in pdf IT-41 Schedule IN K-1. For fiscal year estates and trusts file Form 1041 by the. Indiana estate tax return Wednesday August 31 2022 Edit.

Therefore no inheritance tax returns must be filed at this time. If you file a. The fiduciary return will report only the amount of tax computed on the individual income tax return.

Do not file Form IH-6 with an Indiana court having probate. If there is tax due report the tax. 31 rows Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due nine months after the date of death.

Taxpayer as shown on Form 1041 US. 50217 Fiduciary Payment Voucher 0821. Preparation of a state tax return for Indiana is available for 2995.

No tax has to be paid. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department. The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if.

If you are filing a.

Instructions For Form 1041 U S Income Tax Return For Estates And Tr

Indiana State Tax Information Support

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

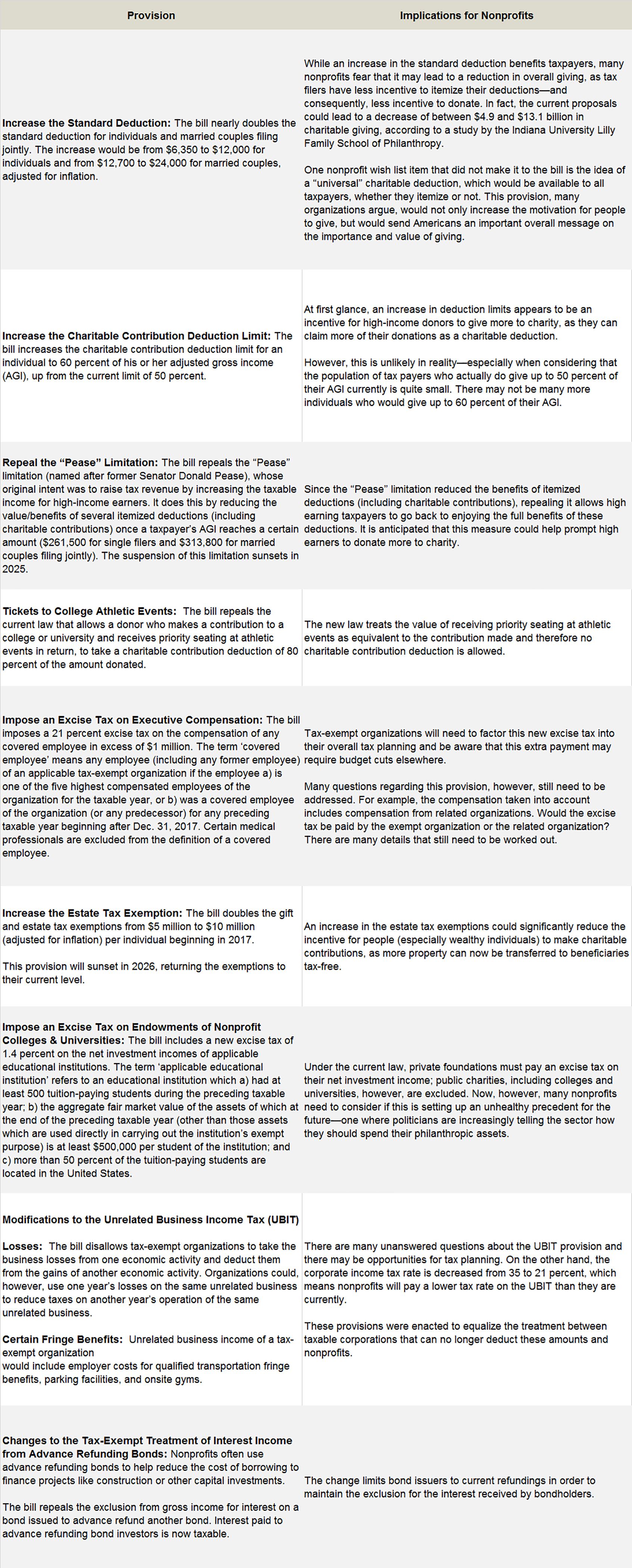

How Tax Reform Will Affect Nonprofits Smith And Howard Cpa

Indiana Gazette From Indiana Pennsylvania On June 5 1999 Page 50

Tangible Personal Property State Tangible Personal Property Taxes

Indiana Property Tax Calculator Smartasset

Long Delayed Indiana Tax Rebate Checks Will Be Larger

States With No Estate Tax Or Inheritance Tax Plan Where You Die

10 Ways To Reduce Estate Taxes Findlaw

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Indiana Inheritance Laws What You Should Know Smartasset

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Holcomb Sets Special Session For Indiana Legislature On Tax Refund Plan

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Guidelines For An Executor Of An Estate In Indiana Indianapolis Estate Planning Attorneys