ohio sales tax exemption form contractor

If a contractor does not pay Ohio sales tax on the tangible personal property to its supplier then it generally owes. The contractor must use a separate Form ST1201 Contractor Exempt Purchase Certificate for each project.

This has significant implications for highway contractors because in effect the courts in Ohio have determined that equipment used even temporarily on a public works project is sold to the public.

. As the consumer the contractor is re sponsible for paying sales or use tax on the purchase of the tangible personal property to be installed. For real property jobs the contractor is considered the consumer of the materials installed and must pay sales or use tax at the time the materials are purchased. A Into real property under a construction contract with the United States government or its agencies the state of Ohio or an Ohio political subdivision.

Make certain each field has been filled in correctly. Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of. They do however pay sales tax on the supplies they purchase.

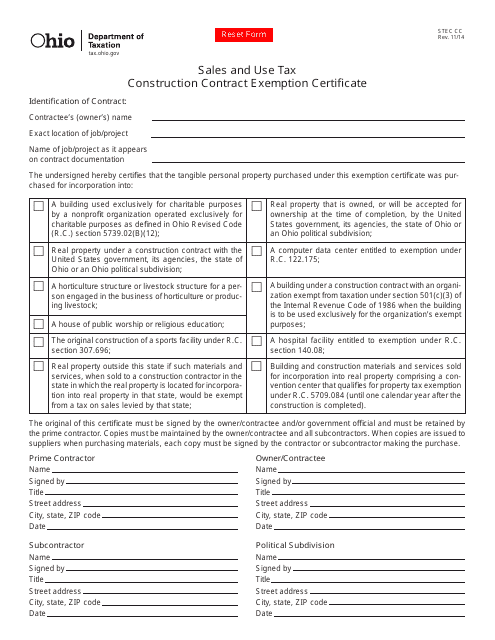

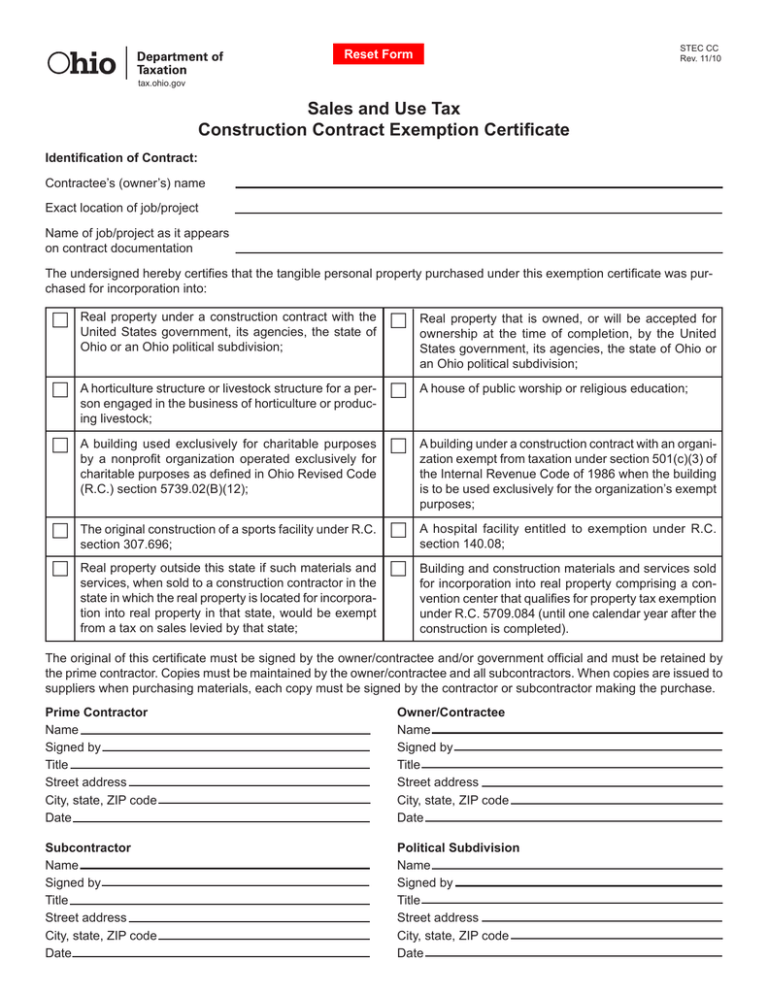

Given that ODOT is a tax-exempt agency like all forms of government in Ohio it is not subject to sales or use taxes under the Ohio Revised Code. Step 2 - Enter the vendors name. Available on the Ohio Department of Taxations website is the form STEC CC which is the construction contract.

You can use three available alternatives. Istrative CodeThis certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. Add the date to the document using the Date feature.

Goods or materials bought for the construction of projects for certain agencies departments etc. Even if the contract is exempt the contractor is still liable for taxes on property not incorporated into real property improvements such as tools equipment and consumables. Are not subject to sales and use tax.

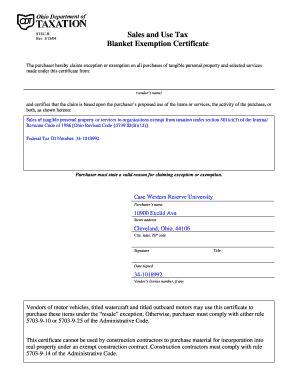

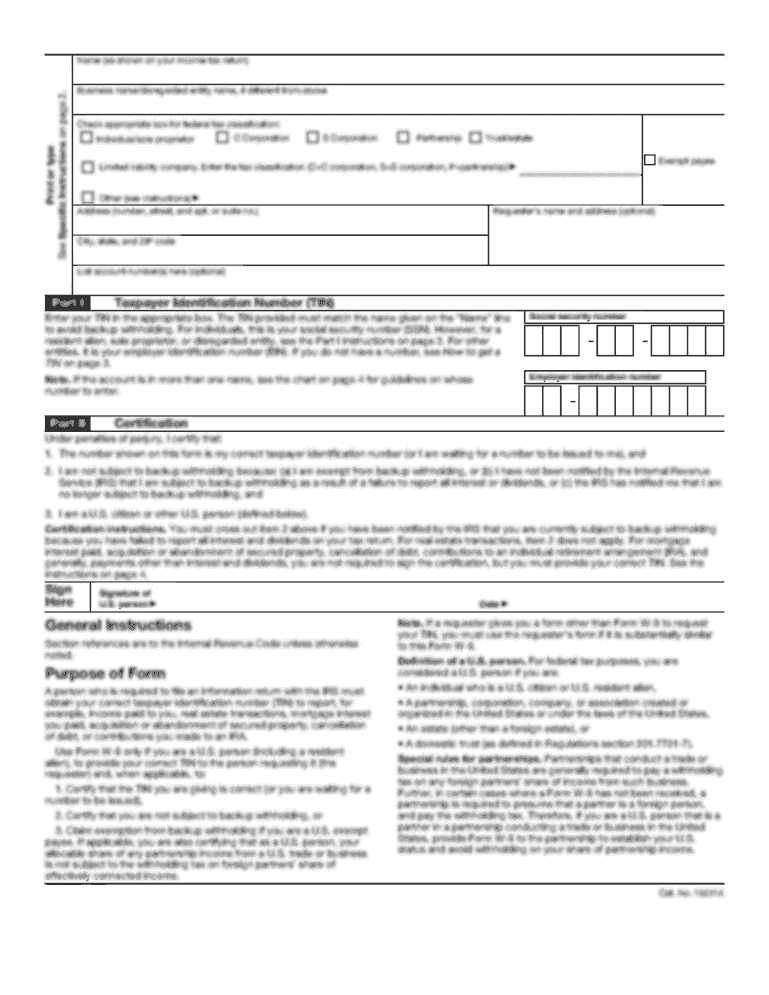

Sales and Use Tax Blanket Exemption Certificate. Sales and use tax. Typing drawing or capturing one.

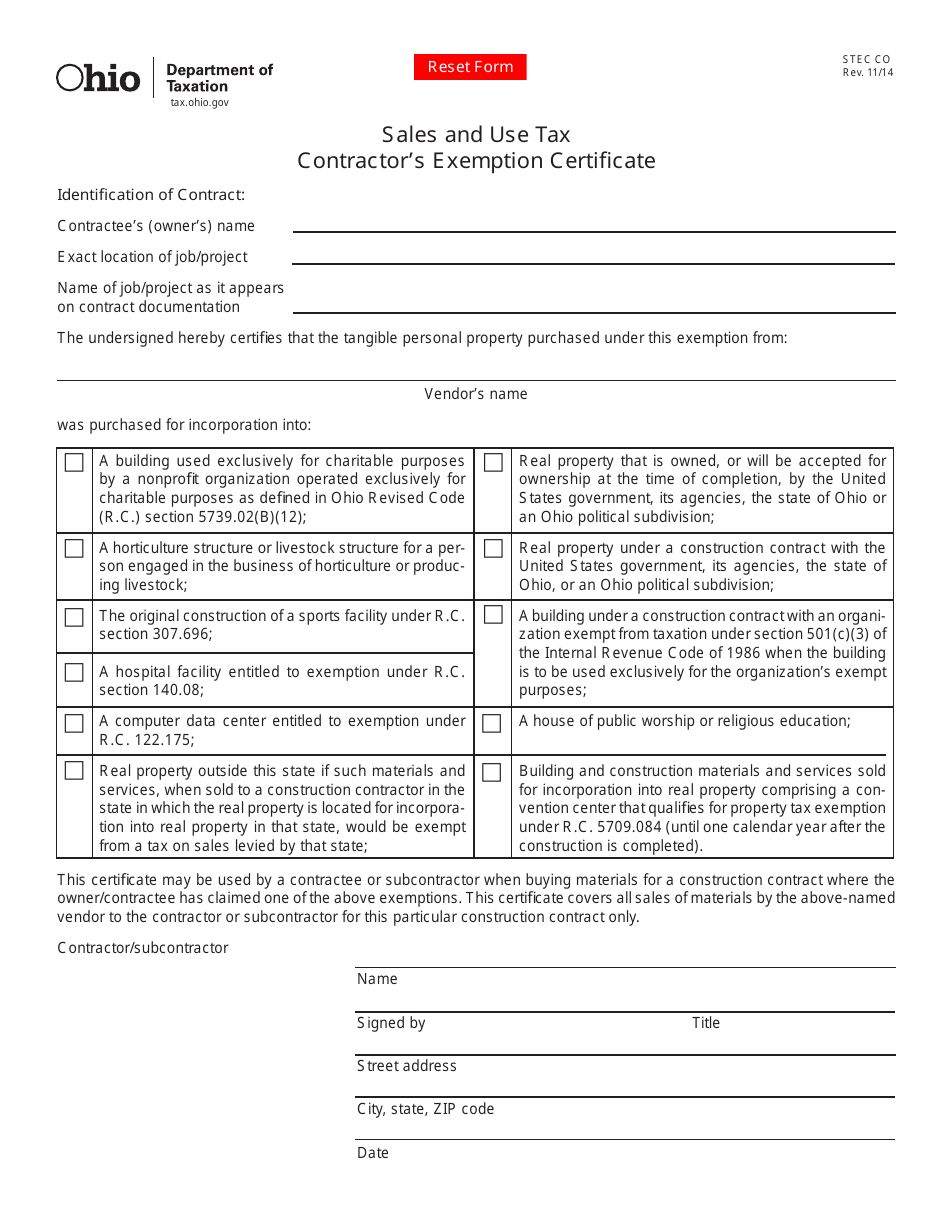

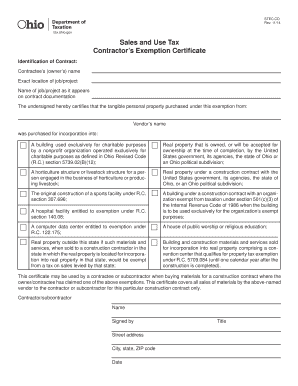

The goods in question should form an integral form of the end structure or reside within the completed structure. Then the contractor should provide Sales and Use Tax Contractors Exemption certificates Form STEC CO to its suppliers. Contractors and home remodelers do not collect sales tax on their work.

Sales Tax in Construction. 2 When claiming exemption under paragraph D1 of this rule the contractee and contractor must issue exemption certificates in accordance with paragraphs I and J of this rule. Real property outside this state if such materials and services when sold to a construction contractor in the state in which the real property is located for incorpora-tion into real property in that state would be exempt from a tax on sales levied by that state.

For other Ohio sales tax exemption certificates go here. B Into real property that is owned or will be accepted for ownership at the time of. Generally a contractor does not collect sales tax from their customer on the performance of a real property construction contract.

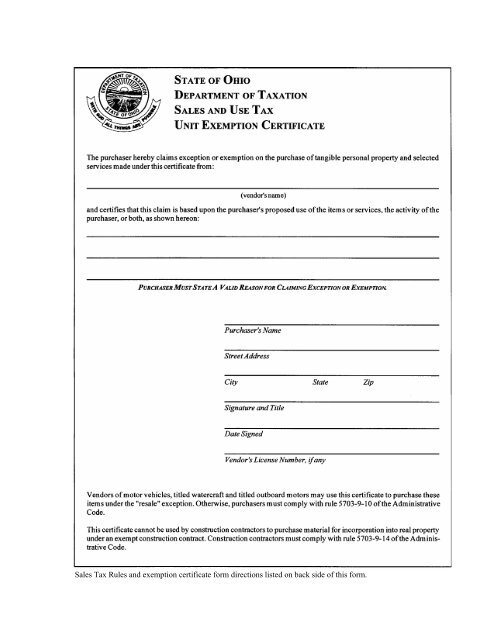

Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the project where the property will be. Step 1 - Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. Contractors purchasing goods to install in a tax-exempt project should use this form.

Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or. The contractor may purchase the tangible personal property exempt from sales tax in this situation as a sale for resale.

Construction contractors must comply with rule 5703-9-14 of the. A Except as provided in section 573905 or section 5739051 of the Revised Code the tax imposed by or pursuant to section 573902 5739021 5739023 or 5739026 of the Revised Code shall be paid by the consumer to the vendor and each vendor shall collect. Consumer to pay tax - report of tax - exemption certificates.

Make sure the info you add to the Ohio Tax Exempt Form is up-to-date and correct. Click on the Sign button and make a signature. A computer data center entitled to exemption under RC.

These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock. You can download a PDF of the Ohio Construction Contract Exemption Certicate Form STEC-CC on this page. D An exemption certificate is fully completed if it contains the following data elements.

Step 3 - Describe the reason for claiming the sales tax exemption. You can download a PDF of the Ohio Contractors Exemption Certicate Form STEC-CO on this page. Ohio law provides that contractors are consumers of the tangible personal property that they install into real property.

For other Ohio sales tax exemption certificates go here. A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code. The buyer can benefit from the exemption by using this certificate when.

2 If a construction contractor is claiming exemption from sales or use tax on the purchase of materials for incorporation into real property the construction contractor must comply with rule 5703-9-14 of the Administrative Code. Nevertheless a construction contractor may purchase exempt from tax those materials or services that will be incorporated. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or services in the event the tax commissioner ascertains that the contractee was not entitled to exemption.

E A construction contractor who also makes substantial sales of the same types.

Tax Exempt Form Pdf Fill Out And Sign Printable Pdf Template Signnow

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Holland Computers Inc

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use Tax Construction Contract Exemption Certificate Ohio Templateroller

Form Stec Co Fillable Contractor S Exemption Certificate

How To Get A Sales Tax Certificate Of Exemption In North Carolina

61 Pa Code Chapter 31 Imposition

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate 2014 Templateroller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Exemption Certificate Forms Department Of Taxation

H 3gov Fill Online Printable Fillable Blank Pdffiller

Printable Tennessee Sales Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

Sales And Use Tax Construction Contract Exemption Certifi Cate

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Form Sales And Use Tax Blanket Exemption Certificate Sales Tax Forms Tax Forms Legal Forms Passport Renewal Form

H 3gov Fill Online Printable Fillable Blank Pdffiller

Construction Exemption Form Fill Online Printable Fillable Blank Pdffiller

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online